capital gains tax canada 2020

Since its more than your ACB you have a capital gain. This results in a total tax liability on the business income of.

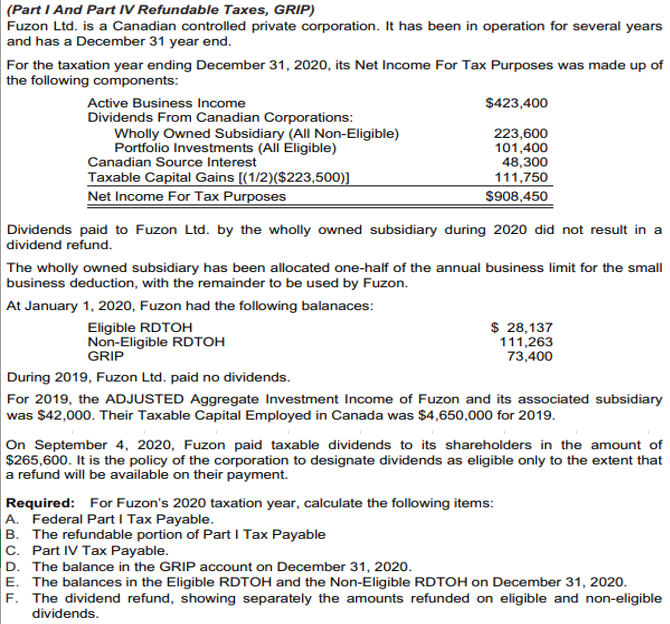

Part I And Part Iv Refundable Taxes Grip Fuzon Chegg Com

Colombia Last reviewed 08 August 2022 10.

. Only 50 of your capital. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total. If the assets were held for two or more years the gain will be taxed as a capital gain at a 10 flat rate recapture rules are applicable.

Dividends distributed within taxable periods commencing after. You may be a partner in a partnership and receive a T5013 slip Statement of Partnership. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

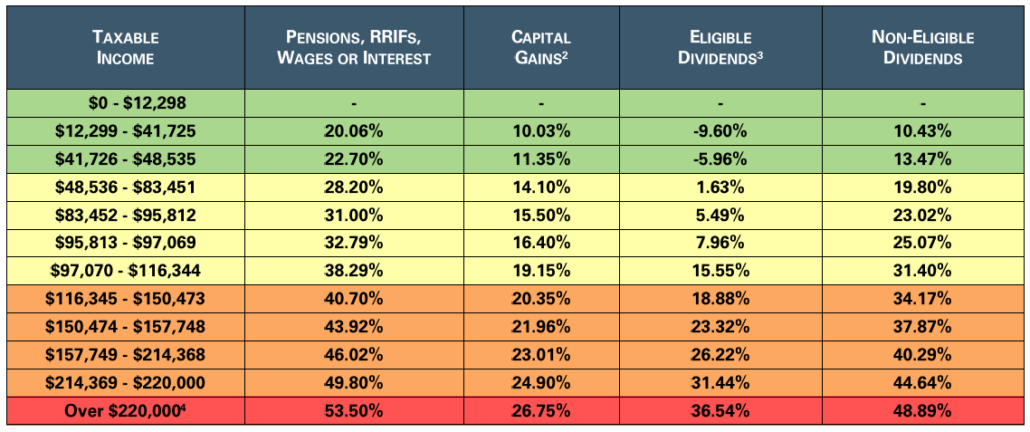

Tax-free basic personal amounts. July 24 2020 at 119. Instead capital gains are taxed at your personal income tax rate.

On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Completing your income tax return. The sale price minus your ACB is the capital gain that youll need to pay tax on. For information on how to calculate your taxable capital gain go to Line 12700 Capital gains.

Capital Gains Tax Rates in 2020. What is the personal tax exemption for 2020 in Canada. There is no special capital gains tax in Canada.

An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also. There are several ways to legally reduce and in some cases avoid paying taxes on capital gains. For best results download and open this form in Adobe ReaderSee General information for details.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. Following the remaining 100000 earnings of business profit from Company X will be subjected to a tax rate of 265. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the.

New Hampshire doesnt tax income but does tax dividends and interest. Schedule 3 is used by individuals to calculate capital gains or losses. By Dan Caplinger Updated Jan 2 2020 at 1004AM.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. How to reduce or avoid capital gains tax in Canada. Your sale price 3950- your ACB 13002650.

For people with visual impairments the following alternate formats are also available.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax Rate Rules In Canada What You Need To Know

Hiking Capital Gains Taxes Bad For The Economy And Canada S Middle Class Fraser Institute

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Reporting Capital Gains Dividend Income Is Complex Morningstar

Misunderstandings About Capital Gains Taxes Fraser Institute

5 Categories Of Tax Planning Alitis Investment Counsel

List Of Countries By Tax Rates Wikipedia

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Possible Changes Coming To Tax On Capital Gains In Canada

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Taxtips Ca Business 2020 Corporate Income Tax Rates

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Engineeringrobo S Cryptocurrency Stock Tax Guide Engineeringrobo

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool